tax avoidance vs tax evasion philippines

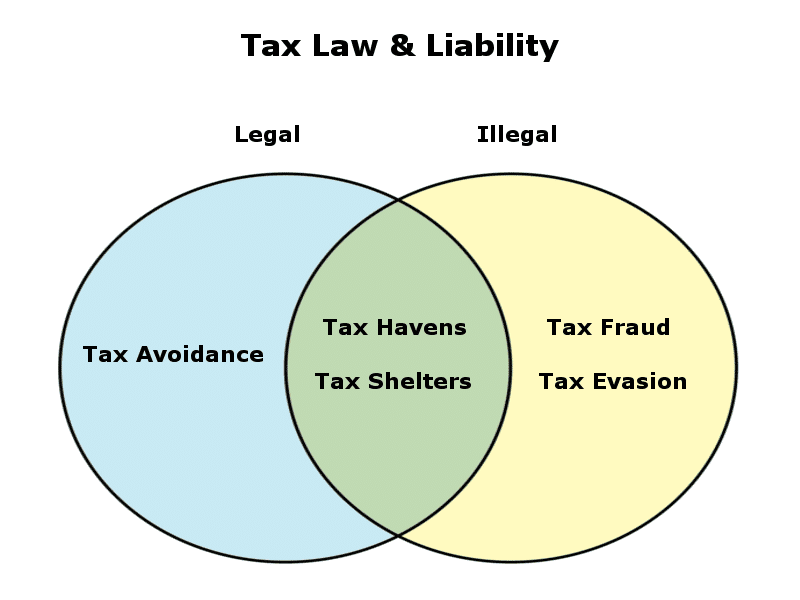

Tax avoidance and tax evasion are different methods people use to lower taxes. The difference between tax evasion vs tax avoidance is tax evasion is illegal while tax avoidance is unethical.

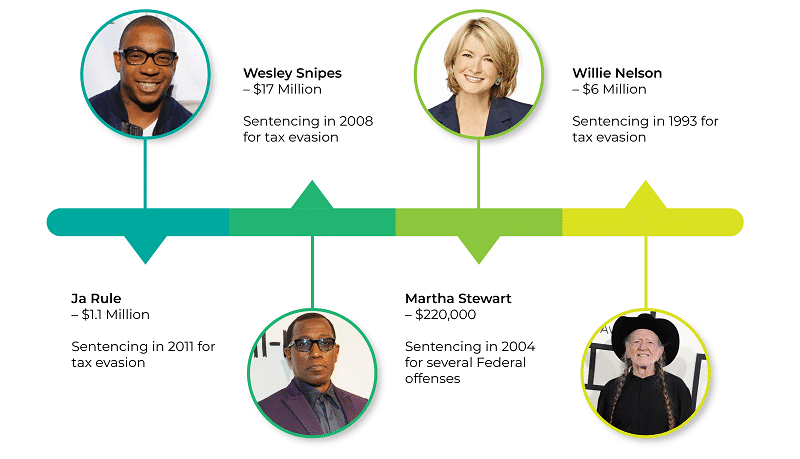

Celebrity Tax Evasion Top 4 Celebrities Who Got Busted Updated 2022

The Supreme Court thus held that there was no tax evasion.

. Consequently what was employed to minimize taxes was a tax avoidance scheme. -1 level 2 monkeyboy123a Op 1y Dont know san yung ethics angle dun. Using tax deductions itemized deductions on sch a business expenses on sch c or form 2106 to reduce your taxable incometax evasion.

This is entirely different from tax evasion which is. In tax evasion you hide or lie about your income and assets altogether. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

The biggest difference between the two is that tax avoidance is completely legal. Tax July 1 2022 arnold. Tax evasiontax avoidance.

Tax Avoidance Law in the Philippines April 4 2022 khalsaevadmin Uncategorized We know that tax evasion is unacceptable while tax avoidance is acceptable. Tax Avoidance Vs Tax Evasion Philippines. Tax Avoidance Vs Tax Evasion Philippines.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. In tax avoidance youre making use of your tax benefits to lower taxes for your small business. Delaying or postponing the.

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law. It can involve misrepresenting your income purposefully.

This is entirely different from tax evasion which is. On the other hand tax evasion refers to illegal attempts to pay fewer income taxes. Tax evasion is an illegal activity that involves lying to the IRS or another taxing authority about the amount you owe.

Tax Avoidance Vs Tax Evasion Philippines. Tax evasion is a felony. Tax July 1 2022 arnold.

Tax Evasion vs. Tax avoidance is the legal utilization of strategies that help you lower your taxes. Tax evasion is the use of illegal means to avoid paying your taxes.

To start with tax avoidance is legal while tax evasion is. Tax Avoidance Vs Tax Evasion Philippines.

Some Of The Best Methods To Prevent Tax Evasion Enterslice

Tax Morale And International Tax Evasion Sciencedirect

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

Tackle Tax Evasion To Fuel Africa S Development

Celebrity Tax Evasion Top 4 Celebrities Who Got Busted Updated 2022

Tax Avoidance Vs Tax Evasion What S The Difference Informi

What If A Small Business Does Not Pay Taxes

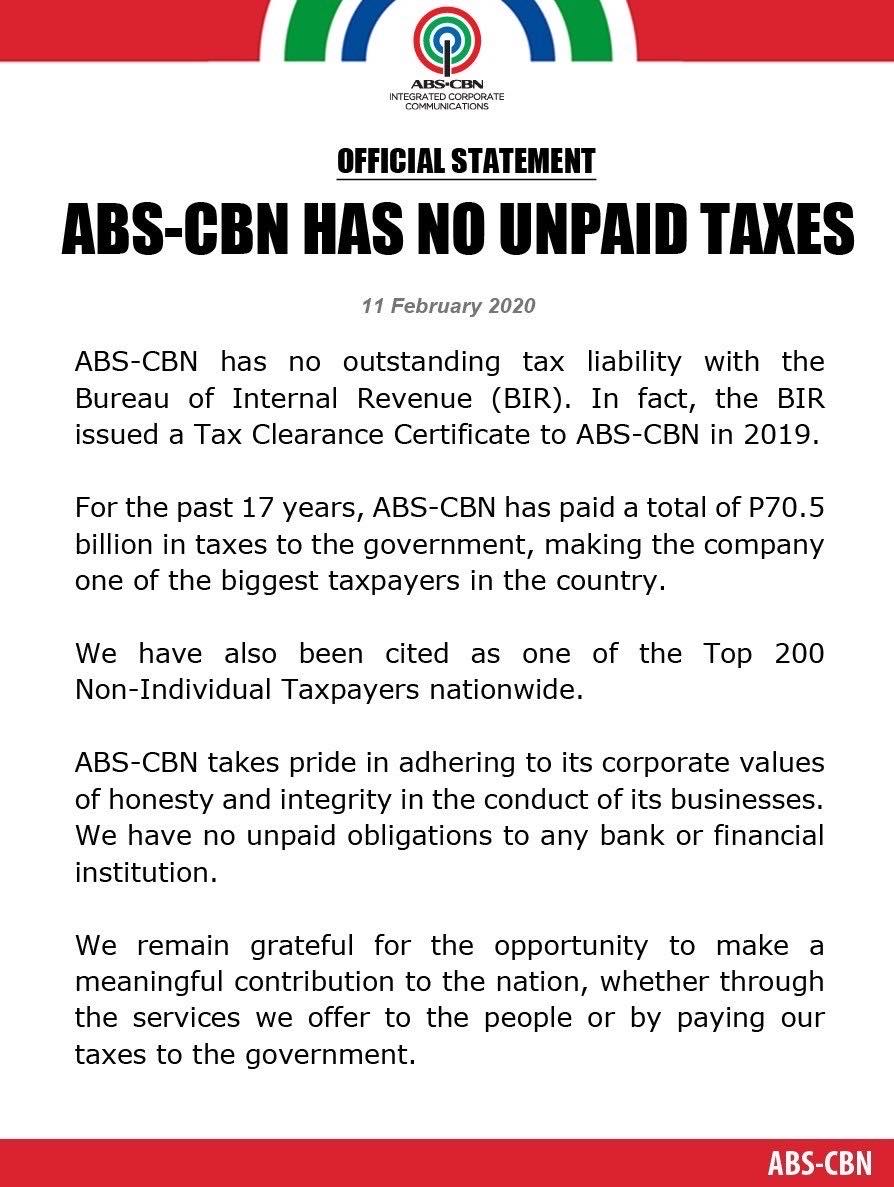

Abs Cbn Tax Evasion Is Fake News Get Real Post

The Economics Of Tax Dodging Econlib

Pdf Tax Evasion In The Philippines 1981 1985 Semantic Scholar

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Some Of The Ways Multinational Companies Reduce Their Tax Bills Piie

Tax Avoidance And Tax Evasion What Are The Differences

Tax Avoidance And Tax Evasion Docx What Is The Difference Between Tax Avoidance And Tax Evasion No One Likes To Pay Taxes But Taxes Are The Law The Course Hero

Ending Offshore Profit Shifting Oecd

The Legality Of The Assault On Tax Avoidance Practices Assistant Studocu

Philippines And Brunei Sign Double Tax Avoidance Treaty

Summary Tax Avoidance And Offshore Wealth Policies For Tomorrow Eutax